The concepts of this post are possible, resulting from nearly 2-decades of observations, personal experience and practical application. Due to the nature of the topic and its sensitivity, I’ve been selective over the years with whom I’ve shared; However; I simply can’t hold this private any longer. This blog post isn’t going to make you feel good – I wrote this to help you (and hope you’ll recognize the utility of it)…

Background

A little over a decade ago, I recognized a fatal flaw in the set of assumptions I made…

I did everything “right,” by today’s standards (so I thought). After high school, I didn’t take a year off to travel through Europe and live life to its fullest. Instead, I went back to school. 10,000 coffees, unimaginable stress and soul-crushing debt later, I collected 3-degrees and subsequently received my title as a Board Certified Chiropractor – soon, started a practice.

When I first started working, I had no patients, so there was only upside to my potential (that’s the sweet-spot, and not unlike a mouse trap).

This picture was taken by my mom the week my best friend and I graduated from chiropractic school (circa 2000) – We’re showing off our “adjusting hands.” OMG that t-shirt I’m wearing! Look at us two-fools – We had no idea the challenges we’d face…

Each year my practice grew, as did my income. However, with practice growth (at roughly a 20% Year-Over-Year Growth Rate), so too did my responsibilities, my stress, number of employees, and all my expenses/liabilities along with it.

Moreover, since I was in a “trading-time-for-dollars” model, I soon hit a ceiling (there will ever only be 24-hours in a day, of which maybe 10 of those are workable).

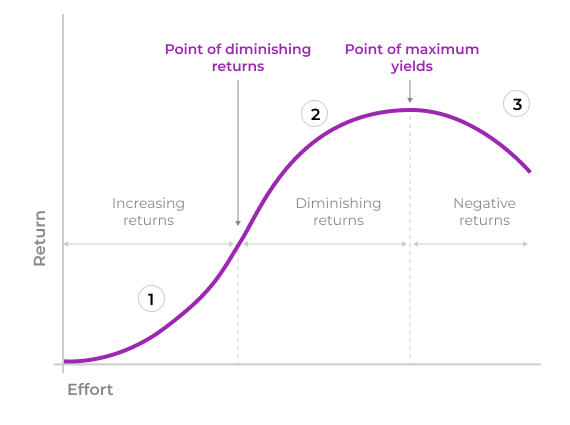

It wasn’t long before I realized I was working akin to driving down the freeway, red-lining in 3rd gear. The return on my investment (time) wasn’t yielding the same real rate of return I achieved the first 5-years during my exponential growth toward my ceiling (this is illustrated perfectly if you understand diminishing returns, see graph below). Hitting that line of resistance stalled out growth and instead maintained (on the surface) what appeared to be a sustainable “healthy” business (with an insidious critical flaw – more on that soon)…

If you’re reading this and feel compelled to educate me on how to outsource my time and grow my practice more efficiently – don’t bother – I’m considered by many to be an expert at that. You’d (not) be impressed listening to me boast about how I created a completely automated massage business and replaced myself as the chief chiropractor of my office, in spite of many people who told me, “it cannot be done” – well… I did it.

In spite of my boastable skills to automate and optimize, ‘this’ fatal flaw persisted and continued to work against my apparent “genius” solutions. At the end of the day, my attempts were futile (and, in fact, only served my ego).

The rules of the game aren’t written on a booklet that never change – in fact, quite the opposite; All too inconveniently, just when you feel you’ve finally gotten ahead and are racing toward the win.

Imagine playing a game based on a set of rules, spending years strategizing how to win, and one day those rules are changed on you! This is exactly what has (and will continue) to happen to everyone who is earning a living. Whether you’re a doctor, dentist, lawyer, bus driver, a small business owner, or an employee with a “guaranteed” salary and “benefits” – you are not immune – you may just not know it (until now, keep reading)… This is the realization I had. This was the primary reason I sold my practice and why I’ve spent the last decade deep-diving on this subject – It’s the most important force we are all facing…and yet, most don’t have a clue.

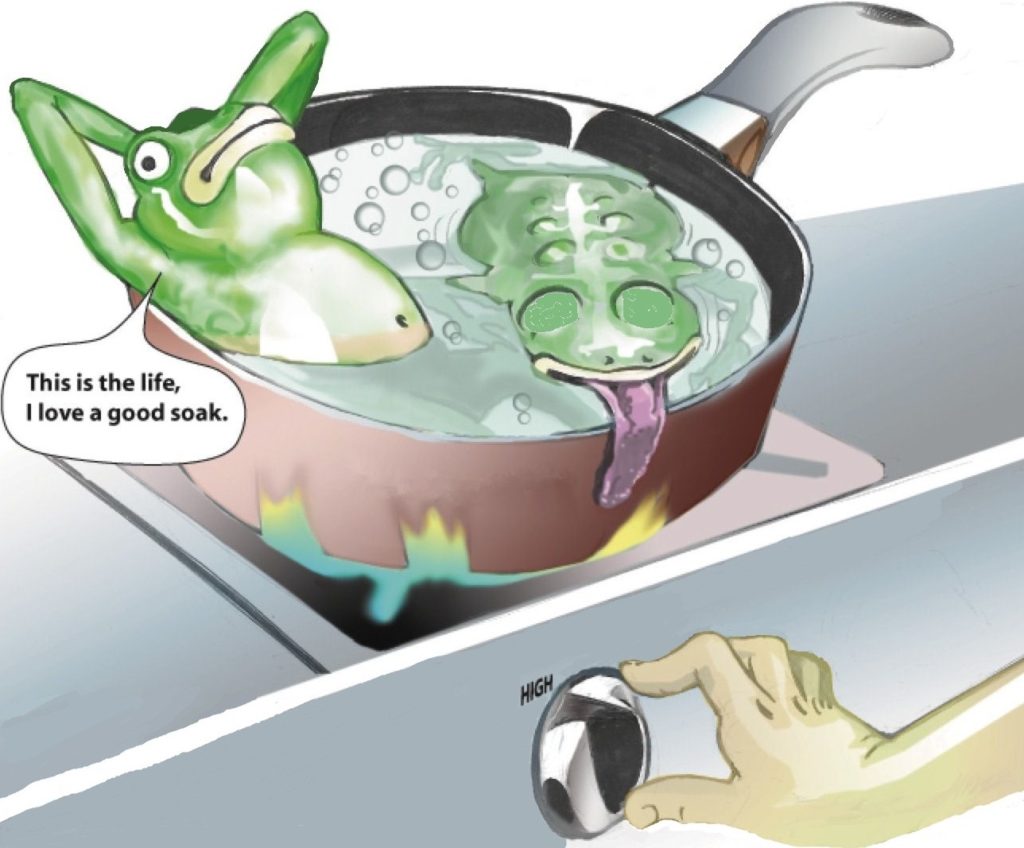

(I’m an animal lover, so please recognize this metaphor as simply an illustration)…

Like boiling a frog, the temperature is slowly risen so the frog doesn’t jump out – instead, it enjoys a warm bath until suddenly it realizes the situation it’s in – unfortunately too late.

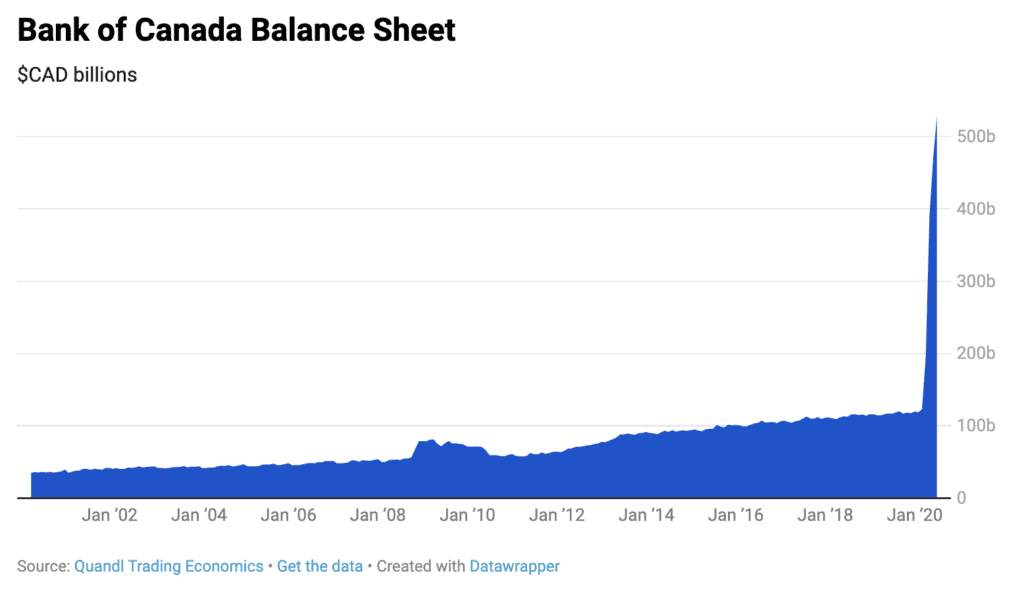

I first noticed this in 2009 after the financial crisis. That was a small bump… Now, as a result of this global pandemic, we’ve turned up the heat to full blast (and every country is doing the same)…the temperature is getting very close to that boiling point – the point of no return. Those who stall on action today will (sadly) not make it. #sorrynotsorry #itoldyouso

Think your country is immune? Prove me wrong.

A quick lesson in finance…

If your household brought in $100,000/year of net income and your expenses were $500,000, you’ve got an obvious problem.

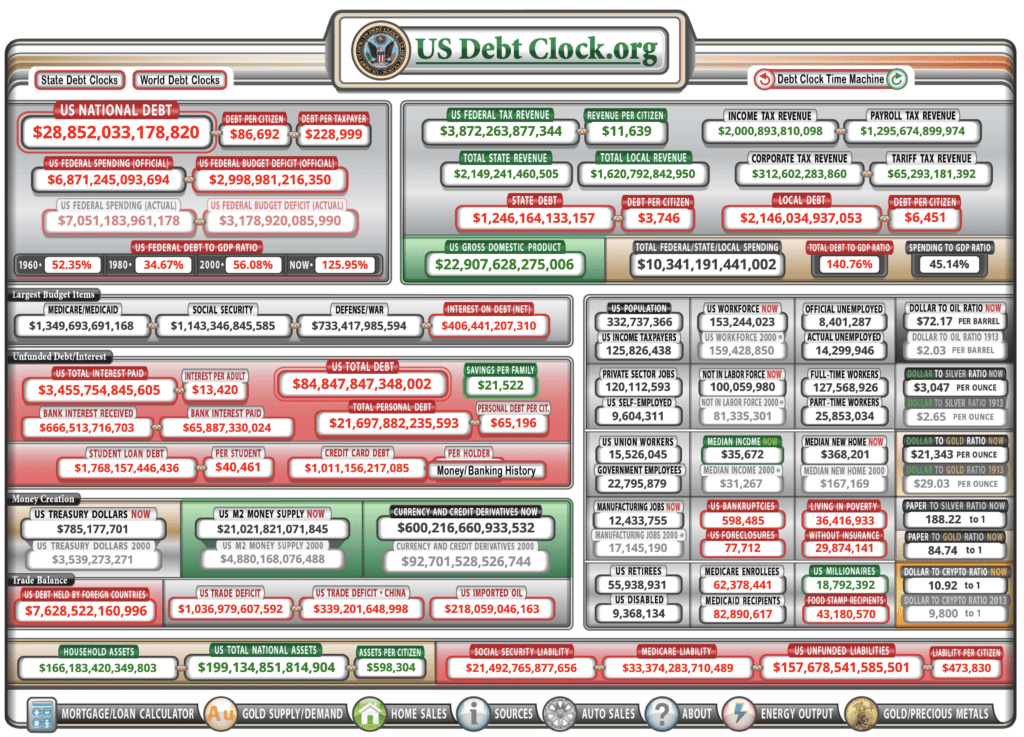

(you can cick this calculator below to see the effect in real time)

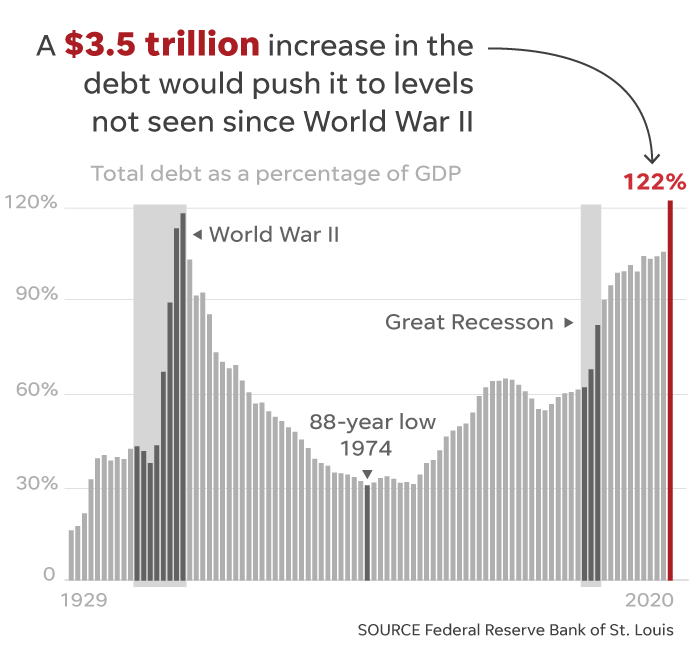

The solution to this problem, ever since we gave up being backed by gold, was simply to turn on the money printers and print more money. Wouldn’t it be nice, if you had trouble paying your bills and could just turn your printer on and print more money to pay your rent? That’s exactly what the United States does. There’s a meme for this…we say, “brrr.”

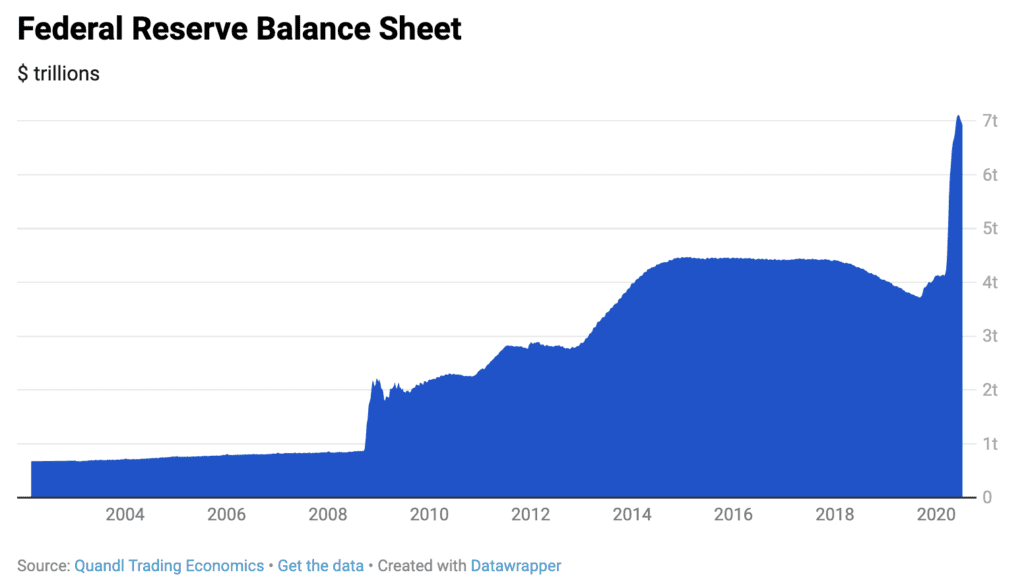

In 2008, when the financial crisis hit, as a result of subprime lending practices, we printed money. To put this in perspective, in the last year we’ve printed 50% of the total amount of USA dollars ever made! This has pushed our debt back to levels not seen since WWII.

‘Every time money is printed, the supply is increased. This causes the money you hold to decrease its power since there’s more of it out there. It’s being diluted, quickly. Imagine a glass of orange juice (which you should never drink if you care about your health, btw). Now add a cup of water to it – that’s what has happened to our money – it’s weak and getting weaker buy the month. More water keeps getting added to it. In fact, you can expect your money to lose its purchasing power at a rate of 15%/year for the next 4-5 years. That means in 5-years, it’ll have lost 75% of it’s strength.

To illustrate this further…

Imagine you wanted to buy a car today for $40,000 using your cash (which you should! It’s quickly becoming worthless anyways). In 5-years it’ll cost you $70,000. But, you’ll need to work 110% harder and earn 110% more in order to afford this. Remember, you’re buying this car with after-tax-money, you’ve got to account for the 35% in taxes you’ll have to pay (hopefully it’s that low). If you divide 110% by 5 years, that means you’ll need to get a 22% raise every single year for the next 5-years in order for this to work out.

When’s the last time you asked your boss for a 22% raise and got it every year for 5-years in a row? Oh, and that’s assuming we don’t print any more money. If they do (and they will), you’ll need to adjust those numbers (which makes it even more unreasonable).

This is a game you cannot win if you continue to play the way you’ve been playing.

You see, the problem here can be grossly summarized like this…

In order to keep up with the rate at which your money is losing its purchasing power, you’ll need to work exponentially harder, earn exponentially more, for money that is becoming exponentially weaker. This is not only unreasonable, it’s mathematically impossible without the help of an alternative plan (which, as you’d expect, I have discovered).

Ironically, I was never great at math. Yet, ‘The Math’ was the reason I sold my practice. Even for someone as mathematically challenged as me, this formula kept me up at night and the more I ran the numbers, the clearer it became obvious I could never get on the right side of that equation doing what I was doing.

So, the new game became: “how do I get ahead of this bad math?”

It became the most significant math problem I’d ever have to solve, and (#sorrynotsorry) a problem you too must (urgently) solve.

One more (depressing) projection, in case you still aren’t convinced and believe you can stay ahead of this… There’s a really good chance whatever job you’ve got now, may be completely obsoleted by robots and/or artificial intelligence. Technological disruption is coming for your job like a tsunami after a quake. In fact, it’s estimated that 50% of jobs, that can be learned, will be eliminated within 15-years.

https://builtin.com/artificial-intelligence/ai-replacing-jobs-creating-jobs

Here’s a few I can see in plain view that I believe will be gone sooner than later…

- Checkout clerks

- Customer service (already happening quickly, if you haven’t noticed)

- General practitioner MD’s

- Radiologists

- Accountants

- Receptionists

- Teachers

- Delivery drivers

- …my list goes on.

For now, I’ll leave you with this…

I you’re not earning at least an annual 22% real yield on your time/money, you’re not going to make it to the finish line. And, even if you are, that’s just barely enough to keep your head above water.

Evaluate everything you’re doing now and if it doesn’t have the potential to generate those returns, I’d strongly suggest you figure out a workable solution (and quick).

I know I’ve left you with more questions than answers…I’ll be back with more on this to help, so consider signing up to be notified of future posts, so you don’t miss solutions that could save your life.

Thanks for reading. Consider sharing this post with a friend who might not realize what they’re in for.

Dr. Nev

Lifestylist

This is not financial advice, Dr. Nev is not a CFP. Any financial decisions you make based on the information provided here are at your own risk and choice.

Dr. Nev offers private mentorship by application/referral only. Please contact his assistant Emily to inquire.