If you spend any amount of time observing people (including yourself), you’ll notice that most everyone appears to be operating the same way…

Working a job 5-days a week to earn 2-days of freedom (a negative 60% Return on Investment), striving for the same things (fancy cars, clothes, gadgets, luxury houses, luxury vacations, kids in an ivy league school, etc). It’s almost as if this “American Dream” has really taken hold – And, it has, by no coincidence.

The masses are racing toward a victorious finish line that doesn’t exist – they’re trying to beat the house, but the house cannot be beat! Yet, somehow the conditioning is so strong, unaware of the futility of their efforts, they continue to race toward this asymptotic goal.

It’s not your fault. Your parents started it before you were even born. They too were indoctrinated into the “casino of life,” addicted themselves to it’s promises to win that jackpot. Before they had a chance to wake up and recognize they’ve wasted their whole life pursuing a wildly unachievable goal under rules calculated against them, cognitive dissonance kicks in to make sure they never speak the truth – only to die with the lie. (Depressed yet?)

Long before they’ve woken up, you’ve been born and are taught the rules and how to play the same game – with the same fate. Fast forward 70 years, wake up, recognize it didn’t work, don’t tell anyone out of embarrassment, die — rinse/repeat.

Some get lucky. People at every casino are occasionally winning the jackpot – once again, by design. If everyone lost their shirt, there’d be no motivation (hope) to keep the masses coming back. Those “outliers” (the 2%) are essential players – they keep the 98% playing-to-lose. It’s all by design.

In 2010, having never been taught how to invest my hard earned money and being and expert student, I decided to educate myself. I was gifted my first money management book, written by an ultra-conservative, risk-averse, East Indian guru who appeared to be about my age (he’d “arrived”).

Since then, I can easily claim that I’ve read the most recognized investment/money books out there. I absorbed them like a sponge and felt, “I finally understand how to get ahead!” But did I? Lets examine what happened when I actually put what I learned into action…

By all accounts, I followed their strategies to a tee. Their plan may sound familiar… Stop going to Starbucks you glutinous a-hole! That coffee everyday is why you won’t be able to retire. If you save $5/day giving up coffee (along with everything else you enjoy), thanks to the “power” of “compounding interest” (the most amazing discovery since sliced bread), you will end up with that million dollars when you’re 65, and have a retirement filled with Lambos, women (or men, or _____) feeding you grapes on a beach in Bora Bora…maybe even your own private jet.

Invest your money in ETFs (exchange traded funds). Diversify! You wouldn’t want to put all your eggs in one basket – that’s risky! If this seems too complicated for you (maybe you didn’t read all the books I read), don’t worry…There’s plenty of “financial professionals” out there who will gladly help you execute this garbage plan. Oh, and they’ll charge you 1% of your entire portfolio balance every year (guaranteed for them) eating away at your yield, whether they make you money or lose it.

If by some miracle, you actually end up living long enough or vital enough to enjoy your 1-million dollar cash prize, they’ll have forgotten to mention that over your 30-years (or more) of prudent saving/investing, thanks to something called “inflation,” your million dollars is only worth (in today’s dollars) $380k. Not quite the honeypot your hoped, eh?

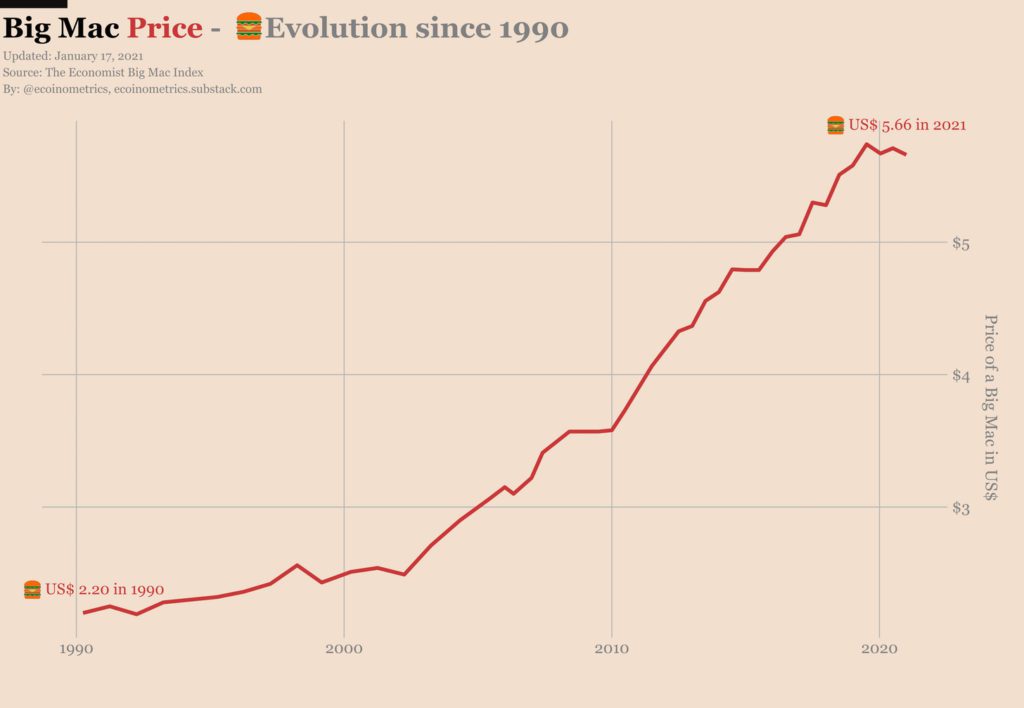

If you’ve been around long enough, you may remember the good-ol-days, when you could buy a BigMac in 1990 for only $2.20. Today, it’ll cost you $5.66 (62% more). And, those numbers would be fantastic compared to what’s actually in store for us all (if you’d like to learn more about that, read my previous article: https://nsydrs.com/the-most-important-game-youll-ever-play-and-you-must/).

Our current inflationary rate has been supercharged (that’s bad) thanks to the previously long-history of mis-money management by our government and the C-19 pandemic, resulting in trillions of dollars being printed by the federal reserve.

Back to my investment results. In 5-years, I managed to realize an overall 9% return on my money. By most accounts, this actually beats most (if not all) professional financial planners (go ahead and ask them for a 5-year overall portfolio performance percentage. You’ll notice they love to report good months or short-term timeframes, but rarely report overall long-term performance. You’ll be lucky if they’re keeping up the S&P500 at roughly 9% pre-pandemic).

Given that I planned to retire while I still have some spunk in my step, it became glaringly clear I wasn’t going to make it – especially considering my money’s power (inflation) was losing strength along the way. At least I didn’t have a financial planner further eating away at my nest-egg profits.

As I mentioned earlier, it’s really important that the masses are kept unaware and playing the wrong game for the house to win. Occasionally, throw a few bones to a few, this helps keep the motivation and hope alive. A casino cannot survive if 98% of its customers are winning, those numbers break their plan.

So, the question you must ask yourself, “are you willing to tow-the-line for the casino” or “wake up and be the casino?” The casino is obviously a metaphor for the financial/work/hamster wheel the masses are on – this is the game 98% of people are playing – a game (I’m suggesting) you’re (statistically) set up to lose.

What about all those financial gurus who wrote those books teaching me how to invest my happiness away for a goal that proves a losing battle only too late for me to do anything about? Well, somehow they’re not doing what they preach – they’re awake, they’ve moved out of the 98% and into the 2% who know better. They sure don’t seem to be giving up Starbucks. In fact, I believe I’ve seen one of them holding a Starbucks Reserve as he got out of his Bently Bentayga, on his way up the steps to his private jet (thank G-d for index funds!).

Hopefully, you’re beginning to recognize there just might be a better way…